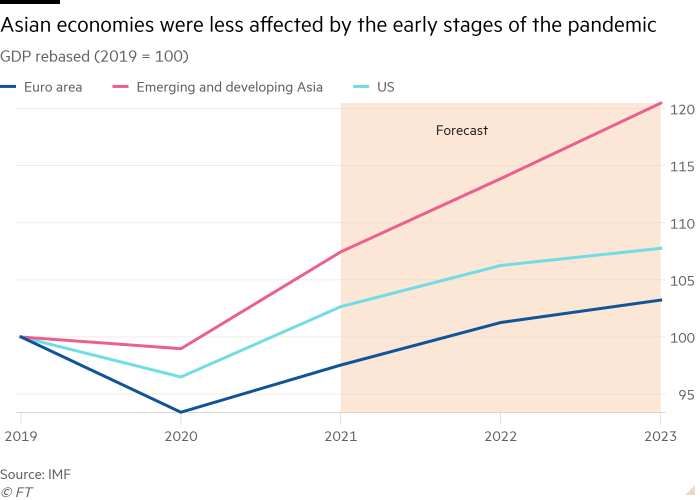

All through 2020, Asia’s success in controlling Covid-19 made it the champion of the world financial system. Whereas Europe and the US had been mired in deep recessions, a lot of Asia escaped with a shallower downturn and even stored rising.

However as western economies gear up for a vaccine-induced rebound which is about to take their output again to its pre-pandemic scale by the tip of this yr, components of Asia are nonetheless paralysed by coronavirus. In consequence, though the area’s output is already above its pre-pandemic degree, slower progress is anticipated within the coming months.

Because it launched its new regional outlook final week, the Asian Growth Financial institution stated that the area’s economies had been diverging and that extra Covid-19 waves had been a giant danger.

“New outbreaks proceed, partly resulting from new variants, and plenty of Asian economies face challenges in procuring and administering vaccines,” stated Yasuyuki Sawada, the ADB’s chief economist.

The ADB projected progress of 5.6 per cent throughout creating Asian economies in 2021, led by progress of 8.1 per cent in China and 11 per cent in India. However the continued menace of coronavirus means dangers to that outlook are skewed to the draw back.

“Six months in the past, or eight months in the past, I’d have stated Asia goes to be forward of the sport as a result of Asia can management Covid,” stated Steve Cochrane, chief Apac economist at Moody’s Analytics in Singapore.

However the image has modified, with India suffering a severe wave of the virus, and circumstances nonetheless excessive in nations resembling Indonesia, the Philippines and Thailand. Thailand is unable to reopen its essential vacationer business.

Extra subtly, nations resembling Japan are solely controlling the virus with restrictions that hold components of the financial system in hibernation. “Some nations want vaccines to manage Covid,” stated Cochrane. “Others want it to allow them to divulge heart’s contents to worldwide journey and tourism.”

The promise of greater than 6 per cent progress within the US this yr, because of President Joe Biden’s fiscal stimulus, would usually have Asian exporters licking their lips.

The outlook, nevertheless, is extra subdued than document US progress would often suggest: People already purchased loads of items in the course of the pandemic, whereas increased US rates of interest would imply tighter monetary situations in Asia.

“Including stimulus at this stage, from the products perspective, is an actual take a look at of whether or not needs are insatiable,” stated Freya Beamish, chief Asia economist at Pantheon Macroeconomics. Because the financial system opens up, US shoppers will in all probability pay for the providers they had been denied throughout lockdown — resembling meals out and haircuts — reasonably than changing their tv once more.

There’ll nonetheless be some spillover from the US stimulus, stated Beamish, noting that service suppliers wanted tools, too. “We suspect that individuals will discover new items to purchase and that Asia will profit from that.” However she added: “We suspect that China will profit proportionately much less from the providers restoration than from the manufacturing restoration.”

Whether or not the additional US demand for items seems to be massive or small, it’s clearly optimistic. In contrast, increased US rates of interest and a stronger greenback would threaten many rising Asian economies with a repeat of the 2013 “taper tantrum”.

Elevated monetary integration and overseas foreign money borrowing imply that the ache of rising US rates of interest is shortly felt on the opposite facet of the Pacific.

“A stronger greenback is now not an unalloyed blessing for Asia,” stated Frederic Neumann, co-head of Asia economics at HSBC in Hong Kong. “It helps exports however tightens monetary situations.”

Nevertheless, inflation is subdued throughout most of rising Asia, and the ADB stated the chance of a US-induced shock to monetary situations “stays manageable at current”. It stated economies resembling Sri Lanka and Laos can be weak if such a shock occurred.

Coronavirus enterprise replace

How is coronavirus taking its toll on markets, enterprise, and our on a regular basis lives and workplaces? Keep briefed with our coronavirus publication.

Some Asian economies are well-placed for the subsequent few years, particularly Taiwan and South Korea, that are uncovered to the semiconductor cycle. “Judging from semiconductor shortages, it doesn’t appear to be the electronics cycle will break down within the subsequent two or three quarters. That tides them over this tough patch,” stated Neumann.

However different Asian economies will discover themselves within the much less acquainted place of counting on home demand to develop. One of many largest query marks is China itself, the place first quarter numbers counsel the financial system has misplaced a little bit momentum.

“Chinese language home demand nonetheless has a strategy to go,” stated Cochrane. “Our forecast proper now could be for 8 per cent progress in China in 2021, but it surely relies upon so much on policymakers and the way shortly they pull again on stimulus and introduce frictions in areas like building.”